Sales for Michelin Group declined 8.3% during the first three months of 2020, and tire volumes fell by 11.7% during the first quarter, as the coronavirus took its hold on the world economy.

As a result of the downturn, in mid-March Michelin implemented five measures to mitigate the impact of the “impending deep recession:”

- tracking supply and demand on a weekly basis to keep inventory under control;

- reducing capital expenditures by 500 million euros;

- reducing the dividend submitted to shareholders by 330 million euros;

- suspending the share buyback program, except for the firm commitments outstanding for 2020; and

- reducing overhead costs.

In its financial report for the first quarter, Michelin stressed its financial stability and security, as well as its focus on the health and safety of its employees and their families.

“The Group reaffirms that it has the sources of financing in place to deal with the uncertainty surrounding the crisis. Stress tests, based on volumes declining by between 20% and 35% over the full year, have shown that the Group has sufficient cash and cash equivalents, without drawing down its confirmed back-up lines of credit.”

As of April 28, 2020, the date the company released its first quarter report, Michelin has 2.3 billion euros in cash and cash equivalents, plus 1.5 billion euros in undrawn confirmed lines of credit.

Florent Menegaux, managing chairman of Michelin, said, “I would like to thank all of our employees for their dedication, commitment and agility, which I am sure will enable Michelin to weather this unprecedented global crisis of still unknown proportions.

“This exceptional situation has deepened our belief that the Group’s culture is anchored in the balance between the engagement of its employees, without whom nothing is possible, the sustainable growth of its business operations and the robust strength of its finances.”

The numbers

Michelin’s total sales were 5.327 billion euros, down 8.3% from 5.809 billion euros for the same quarter in 2019. The company breaks down its business into three general categories.

Automotive (this includes passenger tires): Sales were down 6.9% in the first quarter, 2.597 billion euros compared to 2.788 billion euros a year ago.

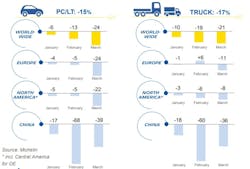

“In falling markets hit by the business impact of the health crisis, the Group reported a 10.5% contraction in segment volumes, thereby consolidating its market share.”

Road transportation (this category includes truck tires, but also replacement light truck tire units): This was the hardest hit category, with sales dropping 12.3%, to 1.360 billion euros from 1.550 billion euros in 2019.

In this segment, Michelin says the markets were down 17%, but this segment reported a 14.9% drop in volumes “cushioned by a favorable geographic mix and the resilience of its services and solutions offering.”

Specialty business (this includes construction truck tires, as well as specialty, off-the-road, aircraft and motorcycle tires): This category was also down 6.9%, 1.370 billion euros compared to 1.471 billion euros a year ago.

Here there were a couple bits of good news, including in mining tires. Michelin says sales of surface mining tires “remained resilient” due to sustained demand from mining companies. In OTR, firm pricing strategies and the tiremaker’s market share “partially offset” the impact of a steep decline in volumes.

Overall, Michelin says the steep decline in volume accelerated in March, particularly over the last half of the month. But the period also benefitted from a 2% increase from a favorable price-mix effect.

“Prices added 0.1%, reflecting the net impact of the Group’s unwavering commitment to disciplined price management, and the expected adverse impact of adjustments from the application of raw materials indexation clauses as of January 1, with the mix effect adding another 1.9% to the sustained up-market shift in the product mix and the strength of the Michelin brand.”

Additionally the company benefitted from a 0.3% currency effect, and a 1% increase from changes in scope of consolidation.

No guidance for the rest of the year

Michelin had already withdrawn its guidance for the rest of 2020, and as of late April the company says the economy remains too unstable to issue something reliable.

“The direction of the pandemic and its economic impacts remain too uncertain to issue any reliable market forecasts and a related profit scenario.

“Nevertheless, at a time of steeply declining raw material prices, the Group expects to see a more positive net price-mix/raw materials effect, which should slightly attenuate the much more pronounced impact of lower volumes.”