Owners and operators of tire dealerships and automotive service shops, no matter how large or small, are being targeted by the United States Department of Labor’s Wage and Hour Division. This is the federal agency that enforces minimum wage, record keeping and overtime rules.

Why are they being targeted? The Department of Labor has identified several “low wage” industries as ripe for compliance audits, and “automotive service” is one of these. As such, no longer is a complaint from an employee required for the Department of Labor to walk into your shop one day and inspect your payroll records for the last two years.

The facts

More than 45% of the audits conducted within the automotive service industries are directed, meaning the Department of Labor not only takes employee complaints into consideration, but also audits these shops for no other reason than you are an automotive service shop. Here are the facts:

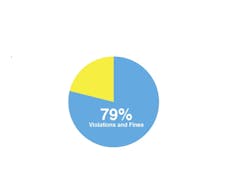

- 79% of all directed and non-directed cases within the automotive service industry result in violations and fines.

- In 2016, there were 516 cases within the automotive service industry, which resulted in $4,265,193 in back wages. This included 4,650 employees. The amount of back wage monies assessed has doubled just in the last six years.

Given these statistics, every automotive service shop should expect either a directed audit (non-complaint driven, random) or a complaint-driven audit. What is concerning is that when we assist owners and operators across the country in responding to the Wage and Hour investigator, they often are completely blind sided and shocked that their pay plans were not in compliance. Wage and hour regulations are extremely complex to begin with. Further, when applying these wage and hour regulations to automotive service shops that have a number of different types and combinations of pay plans (salary, hourly, commissions, flat rate, spiffs and bonuses), compliance becomes complicated.

On the plus side, compliance is attainable and affordable. It’s just a matter of understanding the rules and regulations and how they apply to your business. Because of their complexity, we suggest you contact outside expertise specializing in wage and hour regulations to help you.Case studies

To shed some reality on the subject, consider the following actual cases.

Automotive Service, Employer A:

This employer owns and operates four stores. Each store has nine to 12 employees plus two “managers.” One store manager runs the front desk and oversees the general operations of the store; the second manager (assistant/service manager) performs service writing and directs techs.

The investigator, as in all cases, talked with current employees as well as called past employees to determine job duties and hours of work. Within a matter of weeks, the Department of Labor investigator determined that the employer had two violations.

1. Failing to pay overtime on spiffs and on bonuses paid to service techs and tire technicians (yes, these additional monies paid normally on a monthly or quarterly basis are also overtime eligible).

2. Failing to pay overtime to the assistant/service managers, as the Department of Labor does not consider these positions as exempt from overtime even though they were being paid on a salary plus incentive basis.

The back wages assessed totaled $198,000. The Wage and Hour Division demanded payment immediately. Because the employer wanted to further consider the case due to the severe impact on his operations, the Department of Labor has subsequently sued the company. As a result, at least one and maybe all of the stores will close. Even though the company may go out of business, the Department of Labor also has sued the owner personally for the back wages.

Automotive Service, Employer B:

One day the Department of Labor investigator walked into this company and asked for the owners. The investigator requested the owners provide two years of payroll information for all 48 employees within one week. The case resulted in the following violation:

1. Not paying overtime on spiffs and bonuses provided to service techs and tire changers.

2. The total back wage assessment, including liquidated damages, was in excess of $12,000.

In addition to the actual financial back wages assessed in these cases, the experience is extremely emotional and stressful. The owners must continue to operate their business while trying to compile the voluminous documentation as required by the investigator. If you are investigated, there is no other option but to cooperate and meet their demands.

In addition to the financial as well as emotional stress on the owners, the other challenges for employers include: the Department of Labor contacting and talking to employees; employees with concerns about management’s credibility; and community rumors that could affect your good name and reputation. So there are many other factors that must be considered in terms of why you should ensure compliance.

Common violations

The most common violations within the automotive service industry are as follows:

1. Salaried staff due overtime. Typically, the only position within a shop that meets the “executive exemption” as issued by the Department of Labor would be the owner. In a case of multiple stores, the store manager would be exempt from overtime if his or her primary duty was managing. “Managing as a primary duty” includes hiring, firing, directing employees, training, coaching and counseling, scheduling, etc. A store manager or an assistant manager who 1) is paid on a salary or a combination of salary and commissions without overtime, and 2) is working the counter, engaged in sales, performing service writer work or a combination of any of these as a primary duty, then they are due overtime. Please know that typically an assistant manager and/or service writer would be non-exempt and thus due overtime regardless if you pay them on a guaranteed salary or not.

2. Overtime is due on non-discretionary bonuses. Any spiff, incentive or bonus that is paid to any non-exempt employee is overtime eligible. Year-end discretionary bonuses such as a Christmas bonus would not be considered for this requirement (see example in sidebar).

3. Non-compliant commission on flat rate programs. In a retail setting, a true commissioned employee who earns at least time and one-half (on a federal basis that’s $10.88 per hour; check your state for higher minimum wages) is not due overtime. A number of large chains have implemented pay plans that do not meet the definition of a true commission program (“the more you turn, the more you make”) and have been in violation. Ensure your flat rate system is a true commission system that drives productivity versus a flat shop rate for hours turned. Additionally, the commission piece of the pay program must yield at least 51% of the gross pay. If not, overtime is due.

4. Improper deductions. These improper deductions are normally for “short” clock-ins and outs. For a period of time to be unpaid, the period of clocking in and out must be at least 30 minutes or longer. For an example, if an employee clocks out for lunch at 12 p.m. and back in at 12:15 p.m., then the 15 minutes has to be paid because it is less than 30 minutes. This is normally not a factor for most employees within the automotive service shop except for those who are paid strictly by the hour and overtime over 40 hours.

Again, as stated above, compliance help is both attainable and affordable.

Final tips

Here are some final suggestions for all owners and operators.

- Owners and operators should first review all pay plans. Any position that does not receive overtime needs to be challenged to determine if the position is either exempt form overtime as a manger as defined by the FLSA or meets the requirements of the retail 7(i) commission exemption.

- Ensure that your time records are true and accurate and accurately reflect hours of work. Edit time records prior to sending to payroll to determine if there are any missed punches or any improper punches such as for lunch.

- Implement overtime payment practices to ensure overtime payments on additional monies paid to non-exempt employees who receive overtime paid on spiffs and other types of incentives for sales, safety, attendance, etc. The difficulty here is that most, if not all, payroll services do not make this calculation on your behalf.

Given the rising percentage that your organization will be audited and that your pay practices are probably not compliant, it behooves you to conduct a brief teleconference with a professional to review your pay plans and determine whether or not you are in compliance. You will be completely shocked and surprised that, in fact, you probably are not in compliance and could (probably will) face significant back-wage payments. ■

About the author

Bill Ford is CEO and president of SESCO Management Consultants. SESCO is a human resource consulting firm providing results-oriented human resource consulting services to the automotive service industry. SESCO provides a special “retainer” relationship that provides a free hotline to discuss day-to-day employment issues, including policy development. Ford can be reached by phone at (423) 764-4127 or email at [email protected].