The Chinese tariffs end on Sept. 26, 2012 — what happens then? After shipping and handling expenses, I expect the net unit cost to an importer of Chinese tires to decline by approximately 12% vs. today’s cost, and I would then expect to see an increase in the number of tires that come into the U.S. from China. On the other hand, imports from other low-cost countries such as Indonesia, Taiwan, Korea and elsewhere should decline somewhat with the total number of imported tires increasing modestly next year. During the months of July, August and September, there could be a sharp decline in the number of Chinese imports as no one wants to pay a tariff on tires with the elimination of the tariff so close at hand. Shipments of tires from U.S. manufacturers to dealers could increase in 3Q12 reflecting reduced Chinese imports. Domestic manufacturers who import some tires from China will lower prices modestly with no impact on profitability as any price cuts would be offset with tariff savings. Bottom line: I do not expect there to be any significant change in the dynamics of the tire business here in the U.S. once the tariffs end.

Monthly survey

Independent tire dealers were surveyed concerning current business trends. Except for tire prices and costs, the results of the April 2012 survey are compared with those of April 2011.

Optimism stems from lower gas prices

According to our dealer survey, roughly 57% of passenger tire dealers believe business will stay about the same over the next six months while 43% believe business will improve. As for truck tire dealers surveyed, 50% see business improving while the remaining 50% see business staying about the same. None of the surveyed dealers believe business will worsen. Optimism stems from lower gas costs and the belief that pent-up demand will be filled in the near future.

Passenger tire unit volumes were down 7% in April

According to dealer reports, on average, retail sales of new replacement passenger tires were down 7% when compared with April 2011. Consensus among the dealers we surveyed is that demand is soft and that consumers are buying the minimum needed to get by. Truck tire sales remained strong and were up 4% in April. Retreaded tire sales increased 11% in April after increasing 5% last month.

Manufacturers were getting more aggressive on pricing

In comparing April 2012 with March 2012, average cost for a size 215/60R16 major brand tire was flat while the average price was up 1%. The average cost for a 215/60R16 private brand tire was up 3% while the selling price was up 1%.

Pricing seen as normal to aggressive

In April 2012, 46% of passenger tire dealers saw pricing as aggressive while another 31% saw it as normal. The remaining 23% saw it as firm. On the other hand, 50% of truck tire dealers saw pricing as normal while 38% saw it as very firm and 12% saw it as aggressive. Dealers indicated that major brand manufacturers were pricing more aggressively.

Inventories rise on weak demand

The survey indicated that 50% of passenger tire dealers believed inventories were too high, with 29% believing inventories were in line with current business levels. The other 21% of surveyed dealers believed inventories were too low for current demand. Roughly 60% of truck tire dealers indicated inventories were in line with current business levels; the rest felt inventories were too high.

Service business continues to show growth

Dealers who provide automotive service reported that 28% of revenues, on average, were generated by service during April. Dealers indicated that service business grew by 4% in April 2012 vs. April 2011. ■

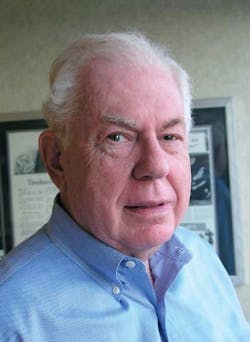

Analyst Saul Ludwig is a managing director with Northcoast Research Holdings LLC based in Cleveland, Ohio. He concentrates on the tire and chemical industries. He has been writing for Modern Tire Dealer since April 1975.