Aggie has been your bookkeeper for more than 20 years. She signs your checks, knows your family, attends church regularly and understands everything about your business. She is indispensable in your shop. Aggie loves to play the slot machines.

Troy has been a technician for just a few years. He’s always done a good job and he’s learning. He recently asked for a raise, but the economy is still down in your area and you just can’t justify more money right now. You think he should be happy he’s working, but he’s not happy.

Darren is a tire installer and helps clean the shop when he’s not busy. He hangs around with a tough crowd, but they don’t bother him at work since you told him they should stay away. He keeps mentioning that he could be getting more money at McDonald’s and the job would be a lot easier.

They all could be stealing from you. Are you sure they’re not?

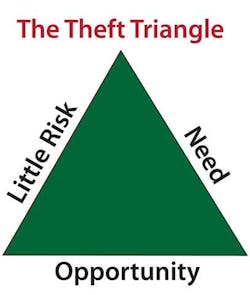

In the business world, there is something called “The Theft Triangle.” It’s a very simple concept to explain. When there is a need and there is little risk, along with opportunity, the likelihood of theft creeps into your business.

In fact, when the three points of the triangle meet, in most cases, theft will occur. In the Theft Triangle, the only point that you can control is risk!

[PAGEBREAK]

Could this happen to you?

Almost every tire store has a dumpster, usually parked behind the business. In one case, a disgruntled employee (could be either Troy or Darren from the above descriptions), decided that he was underpaid and decided to do something about it.

A friend needed a set of tires, and after finding out a set will cost him more than $500, he asks if Troy could get him a deal. Troy says “sure.” After determining what size, the next day, Troy nonchalantly picks up two of the size needed and takes them out behind the shop and tosses them into the dumpster. No one is paying attention and he returns to work quickly.

Late that night, he drives to the darkened shop and picks up the tires from the dumpster. He repeats this the next day and suddenly, he has the four tires for his friend and charges him a real “steal deal price” of $400.

Are you thinking this couldn’t happen in your shop? Think again. When the need is there (employee feels underpaid), the opportunity presents itself (dumpster out back) and there is little risk, theft is likely to occur.

Earlier this year, a story hit the newswires about a woman from a small town who worked in a tire and auto service company with four locations. She had worked as its bookkeeper for more than 20 years and was second in command of the company’s finances.

About 10 years ago, she started altering the books to cover up bimonthly electronic deposits of $5,000 to $7,000 into her personal bank account.

She was very clever and manipulated a double ledger to conceal it.

A company audit turned up a deficit of between $860,000 and $1 million. She received a 9-1/2 year prison sentence and was ordered to pay restitution to the business.

Steps to prevent theft

What can you do to prevent theft or embezzlement in your business? Here are a few simple steps you can take to make sure your employees are as honest as you are.

1. Monthly inventory. You should do a physical inventory once a month to make sure that your tires are accounted for. While this is a hassle, the end result is a much more accurate balance sheet and proof that your employees are honest. And, schedule these inventory audits at different times so that you keep potentially dishonest employees guessing.

2. Employment records. Be sure that you do background checks on all employees — from every level. Since the laws are so sensitive in this area, employers can’t tell you if they fired someone for stealing or some other indiscretion. But, you can ask a crucial question to understand if the person left on friendly terms: “Would you hire this person again?” The answer to this will tell you a lot about whether or not you want this person on your team.

[PAGEBREAK]

3. Drug testing. You must follow all of the laws and have guidance from your attorney or human resources professional in order to test your employees for drug use. It is important that you are consistent with your policy, meaning that you test everyone from managers and sales staff to technicians without exception. If you are a member of the Tire Industry Association, you have access to human resource guidance from SESCO Management Consultants.

4. Employee involvement. Ask your employees to be on the lookout for theft. If an employee is stealing from you, he or she is stealing from your employees by reducing benefits, bonuses, etc. You can give your home phone number and just ask employees to call anonymously and tell you who is stealing. Catching them is easy once you know where to watch.

5. Cash refunds. Be on the alert for credits in the daily register, all entered by the same employee. They could be entering phony credits and taking cash from the register.

6. Surprise audits. Check your cash drawer for post-dated checks to see if any of your employees have “borrowed” funds with the intent to pay them back via the check reminder.

Also, run a mid-day invoice register to verify the cash balances.

7. Security cameras. This is a good investment in making sure that “honesty is the policy” in your business. It also helps if a customer claims damage to their vehicle occurred while on your lot.

8. Dumpsters. Put a light on your dumpster so that even in the dark of night, it is riskier to pick up hidden tires.

9. Manual tickets. These are never a good idea, especially given the wide selection of computerized point-of-sale systems. Any time your system is hand written, it is an invitation for fraud. Your employee could be working with one of your customers, fix the car, and then throw away the manual ticket.

10. Hot shot deliveries. Make sure that every part ordered from your parts supplier comes in with a purchase order specified on the vendor invoice. Also match up the purchase orders and vendor invoice numbers with the customer billing invoice to make sure that all parts are billed correctly.

11. Opening the mail. Bookkeepers should not open the mail. If you receive tax notices, past due advisories or other warnings, the person opening the mail could discard these important documents to keep fraud hidden. The bookkeeper should not be the gatekeeper.

12. Bank deposits. If you receive checks from your customers, someone other than the bookkeeper should run a tape of the total amount of the checks and give this tape to the owner. He then should make sure that every day, the amount of the deposit for checks agrees with the adding machine tape for that day.

Many times, bookkeepers have stolen checks from their companies and opened separate accounts and deposited these checks in their accounts.

[PAGEBREAK]

13. Bank statements. Always be sure to have the company bank statement mailed to the owner’s home. He or she should then review all of the checks written for the month. Many times bookkeepers will write a check for personal items or to themselves, and the only way to discover this is to look at each check that has cleared the bank.

14. Credit card statements. These, too, should be mailed to the owner’s home, and all charges reviewed for accuracy.

Even though restitution is ordered by the courts in the case of an embezzlement conviction, little thefts every day can impact your bottom line. Even something as small as “borrowing” a postage stamp to mail a personal letter can impact your bottom line. Or, something as simple as employees taking a can of soda from the machine can cost you. If your business is making 5% net profit, see Chart #1 above for what you need in sales to offset these little thefts.

Not everyone is a crook.

If Aggie gets in over her head with her slot machine hobby, she may see the opportunity to “borrow” a few dollars from the business to cover her losses just until she hits a jackpot. Meanwhile, your profits disappear.

Troy has a family and really wants to get ahead, but you are holding him back. He may believe you “owe” him, so the chance to sell a few tires on the side doesn’t really seem dishonest.

Darren’s friends keep telling him he’s stupid not to take his fair share of your money. You are a big, successful tire dealer making lots of money, so you won’t miss a few tires here and there.

The success of your business depends on your employee team. It’s up to you to keep them motivated, well-trained and focused on their jobs each day. It is also up to you to keep them honest.

Even small businesses can rack up big losses when the need and opportunity meet up with little risk. The bookkeeper at the small town tire dealership described earlier is a case in point: Nearly $1 million can go missing in an operation with just four stores!

You work hard for your money. Don’t give it away. ■

Norm Gaither is president of Dealer Strategic Planning Inc., a company that promotes “20 groups” in multiple industries. He is a well-known consultant in the automotive aftermarket and has owned his own firm since 1984.