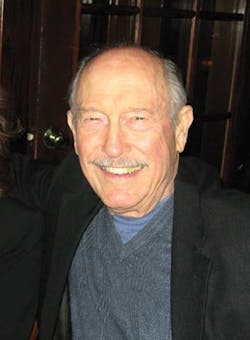

Having consulted for some of the largest mining companies in the world for the better part of the last half-century, Richard Bullock knows mining.

As a member of Purcell Tire & Rubber Co.’s board of directors, Bullock — who also serves as a senior associate with minerals industry consultant Behre Dolbear & Co. Inc. — knows OTR tires, too. (He teaches mining engineering courses at the University of Missouri, as well.)

Bullock’s background gives him a unique, birds-eye view of the mining industry and how the various dynamics within that industry impact OTR tire sales.

In this exclusive interview with Commercial Tire Dealer, he discusses the state of U.S. mining, the impact of the recession on mining activity, pending legislation he believes will be disastrous not just for the mining industry but also for the nation’s economy, and more.

CTD: What is the current state of the U.S. mining industry?

Bullock: The mining industry runs on financing. Venture capital has virtually dried up. Mining isn’t that popular as far as venture capital goes, (but) in tough times, it’s even harder to raise money to bring on new projects.

CTD: So as a result, mines have pulled back on production?

Bullock: They have, and they’ve stopped developing new mines — not everywhere, but certainly in the U.S. From a normal year, the industry is probably down 20%.

CTD: What impact has this had on commodity prices?

Bullock: They started dropping rapidly, some faster than others. Copper and zinc were hit the hardest, at least out of the base metals. There was a group trying to reopen some zinc mines in Tennessee. They put about $30 million into the project, but the zinc price went from $2 down to 70 cents. They canceled the project because 70 cents was very close to their break-even and they couldn’t afford it. So they sold (the operation) to another company.

CTD: Mining has always been a boom-bust business, but it seems like the most recent decline happened a lot faster than previous downturns. Is that an accurate observation?

Bullock: Not only that, but I’d say the recession in general across all sectors was quicker this time. Mining is no different (than other industries).

Once mining companies realized they weren’t going to be able to sell their product, they wisely cut back their production very quickly. Sometimes they don’t do that. But this time they reacted very quickly, and therefore didn’t have to carry big inventories.

[PAGEBREAK]

CTD: Did a lot of mining companies see the recession coming?

Bullock: No, they did not see it coming. I don’t think anybody saw it coming. Everybody said, ‘Well, there’s going to be a downturn eventually,’ but nothing close to what happened.

CTD: What impact have production curtailments had?

Bullock: It cost a lot of layoffs. In some cases, (mines) went to fewer working days per week and didn’t have to do layoffs. But it still amounts to a curtailment.

CTD: The limbo in which the construction market happens to be mired probably hasn’t helped matters either...

Bullock: It’s hurt us. The main thing is the construction market is not using our products. An awful lot of the mining industry is tied to aggregates, and aggregates really took a hit. They’re still down and they’re going to stay down until construction goes back up again.

Overall, I see the mining industry rebounding slowly and cautiously, and I think it’s going to continue to expand, provided the government doesn’t do something... to cause another recession.

CTD: What do you mean?

Bullock: Passing the cap-and-trade bill, for one thing. Mining will be hit very hard. We run a lot of equipment on electricity.

Most of the energy from Appalachia to the Rocky Mountains comes from coal. Energy costs are going to go up, and it’s going to hurt the mining industry. It’s going to limit production.

CTD: Do you think cap-and-trade legislation will be approved?

Bullock: I don’t think it will, and I hope to God it isn’t. If it passes and after it really takes effect, I think it will cause another recession.

CTD: Are there any other legislative issues that could impede the mining industry’s recovery?

Bullock: If the government gets tougher and tougher on (mine) permitting, which is already difficult, that will certainly be a problem.

CTD: Let’s say cap-and-trade doesn’t happen and permit rules don’t get more oppressive. How soon can we expect to see meaningful recovery in the mining industry?

Bullock: Maybe by 2012.

CTD: What elements have to come together for that to happen?

Bullock: Basically the stock that the mining industry has built up needs to be worked off. In some cases, they’re already coming down. Copper inventory is down and zinc stock has dropped the last couple of months.

In other areas, I think stocks are still building because of Chinese capacity. China is gobbling up commodities all over the world.

As their economy continues to grow, they’re going to pull their resources from elsewhere besides the U.S.

[PAGEBREAK]

CTD: Back to the U.S., has any of the stimulus money that was released last year trickled down to the mining industry?

Bullock: Certainly any construction projects have helped the mining industry, but it’s been very limited.

CTD: Serving on the board of Purcell Tire & Rubber Co., you have a unique perspective. How do problems in the mining business impact OTR tire dealers?

Bullock: I think the problems have certainly hurt them.

CTD: Do you see any growth areas in OTR tires?

Bullock: Most of the growth is going to be overseas. That’s where most of the big tire growth is going to be. People who are positioned to do tire business in those countries are in better shape than we are in this country.

CTD: What’s your advice to American tire dealers who may be sitting on tons of OTR tire inventory?

Bullock: All we can expect is slow (mining industry) growth — maybe 3% a year. I’m skeptical that we’re going to see much of a turnaround.

It will be at least until 2012 before we get back to where we were (in 2006 and 2007) in tons of production.

However, there are some bright spots, according to Bullock. “The gold industry is going like gangbusters. Most of the gold in our country comes from underground mines, as does platinum. Silver is at an all-time high, and there are silver mines that are doing well.”

The Alberta oil sands are still producing at high levels, as well. “They’re doing fine. Their production is up.” ■