Gen X and Gen Y consumers are more likely to switch tire brands when purchasing their first set of replacement tires. They're also more receptive to brands outside the Big 3, according to the J.D. Power and Associates 2016 U.S. Original Equipment Tire Customer Satisfaction Study.

Large, established tire brands such as BFGoodrich, Bridgestone, Goodyear, and Michelin still have the highest consideration rates among all generations. However, Gen X (born 1965-1976) and Gen Y (born 1977-1994) consumers are more likely than Boomers (born 1946-1964) and Pre-Boomers (born before 1946) to consider smaller or newer U.S. market brands like Cooper, Hankook and Pirelli when replacing the OE tires on their vehicle.

Additionally, 70% of Gen X and 72% of Gen Y owners switched tire brands if they replaced two or more tires, a significantly higher rate than for Boomers (59%) or Pre-Boomers (61%).

“Gen X and Gen Y are more receptive to the lesser-known brands in large part because those manufacturers have focused their marketing efforts on younger consumers,” says Brent Gruber, director of the global automotive division at J.D. Power. “These consumers are increasingly looking at the value proposition, not just the cost or brand of the tire; if the perceived value is there, they’re willing to spend more or consider alternative brands.”

Given the size of the U.S. passenger and light-truck tire market—nearly 300 million tires, with more than three-fourths of that coming from replacement tires—Gruber says manufacturers cannot afford to ignore younger consumers. Gen Y and Gen X combined accounted for 53% of new-vehicle retail sales in 2015, up from 50% in 2014.

“The OE tire experience generates a lot of replacement tire sales, so it’s critical for manufacturers to ensure that they’re providing a positive experience and building future loyalty,” says Gruber.

“There is a lot of business at stake, and tire manufacturers are faced with a large and growing younger customer base that isn’t necessarily as brand loyal as previous generations. The key to attracting and keeping younger customers is to demonstrate the value and performance of the tire.”

The study measures tire owner satisfaction in four vehicle segments: luxury, passenger car, performance sport and truck/utility. Satisfaction is examined in four measures: tire wear, tire ride, tire appearance, and tire traction/handling. Study results and rankings are based solely on owner experiences with their tires after two years of vehicle ownership.

Overall tire satisfaction after two years of ownership is highest in the youngest and oldest generations. Overall satisfaction in both the premium and non-premium segments is highest among Gen Y owners (708 and 674, respectively, on a 1,000-point scale). Among Pre-Boomers, overall satisfaction in the premium segment is 704 and in the mass market segment 672. Satisfaction among Gen X in the premium and non-premium segments is 692 and 655, respectively, the lowest among all generational groups. Gen X is significantly less satisfied than the other age groups in the tire wear measure.

Key Findings

Tire performance and satisfaction tend to decline to a certain point as mileage accumulates on the tires. Satisfaction averages 702 within the first 5,000 miles and dips slightly to 693 within the first 15,000 miles. However, satisfaction drops sharply after 25,000 miles to 648. Once a tire reaches this point, customer satisfaction is fairly constant until the tire needs replacing.

Owner satisfaction with tire traction in poor weather conditions after one year of ownership remains unchanged versus last year at 6.9 (on a 10-point scale). After two years of ownership, satisfaction with tire traction is 6.6, up slightly from 6.5 in 2015.

J.D. Power says, "The improvement at two years is certainly a step in the right direction, but there is still considerable room for improving this important performance attribute."

Only 25% of customers who experience a wet traction problem with their tires say they “definitely will” or “probably will” recommend their tire brand to others, compared with 69% of those who have not experienced this problem.

The 2016 U.S. Original Equipment Tire Customer Satisfaction Study is based on responses from 31,977 original owners of 2014 or 2015 model-year vehicles. The study was conducted from October through December 2015.

Study Rankings

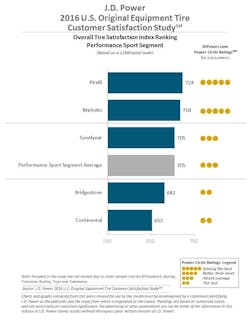

And here's how the brands rated. (See graphics showing the survey results at the bottom of this story. And you can download the graphics here.)

Michelin ranks highest in three of the four segments: luxury (742), passenger car (724) and truck/utility (698). Pirelli ranks highest in the performance sport segment (724).

Pirelli ranks second in the luxury segment (705), passenger car segment (689) and truck/utility segment (680).

Goodyear ranks third in the passenger car segment (684.)

BFGoodrich ranks third in the truck/utility segment (663).

In the performance sport segment, Michelin ranks second (718) and Goodyear third (705).