It is safe to call retreading a mature market, based on the results of our 2013 Modern Tire Dealer Retreaders Survey. More than 85% of the estimated 680 domestic retread plants have been in business more than 20 years.

Retreaders in the United States were emailed a series of questions to determine the makeup of the average truck tire retreader, and to help set industry benchmarks. Here are the results.

Q. How many years has your company been in retreading?

Less than 10 years: 8.2%

Over 10 years but less than 20: 6.1%

20 years or more: 85.7%

Analysis: The number of retread plants in the U.S. has dropped nearly 80% in the last 30 years.

Q. How many retreads do you produce in an average day in the following categories?

Light truck per day: 15.3

Medium/heavy truck per day: 246

Analysis: In our 1995 Retreaders Survey, the average truck tire retreader produced 68 retreads per day. At that time, there were 1,385 retread plants in the U.S. Based on the number of retreaders today (680) and the average number of truck tires retreaded per day by survey respondents (246), retread plants in 2013 can produce 75% more retreads daily with 51% fewer shops.

Q. Do you plan to expand your capacity in the next 18 months?

Yes: 43.7%

No: 56.3%

Analysis: When asked, “Do you plan to expand your capacity during the next 12 months?” 57.8% of the retreaders in 1995 said no. That is not that far off from the percentage drop in the number of retread shops since then (51%). Coincidence?

Q. If you answered yes to the previous question, how do you plan to expand?

Build new plant: 0%

Expand an existing plant: 57.1%

Add an additional shift: 42.9%

Analysis: The newest retread plant in the United States was built by DLS Retreading Inc. in Fort Mill, S.C., this year. It is a ContiTread plant, the ninth in the U.S. and 20th in North America.

Q. Are you planning to buy new equipment in the next 18 months?

Yes: 38.8%

No: 61.2%

Analysis: Inspection equipment topped the list of equipment needed. In our 1995 survey, in which 44.8% said they were planning to buy new equipment, the most common pieces mentioned were tread rebuilders and molds.

Q. Is SmartWay verification necessary to sell retreaded tires?

Yes: 27.7%

No: 31.9%

No, but it will be: 40.4%

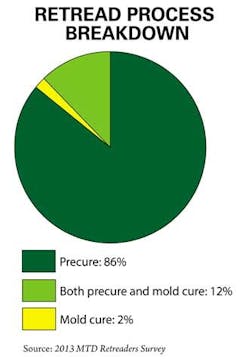

Analysis: There are seven precure brands on the Environmental Protection Agency’s SmartWay-verified retread technologies list: Bandag, ContiTread, Goodyear, RingTread, Michelin Pre-Mold, Oliver and PreQ Galgo (one trailer tire). There are two mold cure brands on the list: AccuTread and Michelin Custom-Mold. ■

Where are the casings? Retreaders rank their challenges

When asked to rank their challenges as a retreader, respondents had a clear number one: casing availability.

”On a scale of 5 to 1 with 5 being a major challenge and 1 being lowest, how would the following issues rank in terms of challenges to your business?”

1. Availability of casings: 4.02

2. Price of new truck tires: 3.47

3. Cost of raw materials: 3.46

4. Too many competitors: 3.22

5. Resistance from fleets: 2.66

6. Government intervention: 2.63

We also asked them to rank “pressure from new tire manufacturers to use their retreading systems” as a challenge. It came in at 2.46, by far the least important challenge.

About the Author

Bob Ulrich

Bob Ulrich was named Modern Tire Dealer editor in August 2000 and retired in January 2020. He joined the magazine in 1985 as assistant editor, and had been responsible for gathering statistical information for MTD's "Facts Issue" since 1993. He won numerous awards for editorial and feature writing, including five gold medals from the International Automotive Media Association. Bob earned a B.A. in English literature from Ohio Northern University and has a law degree from the University of Akron.