OTR tire market faces an uphill climb

The Off-the-Road (OTR) Tire Conference, hosted annually by the Tire Industry Association (TIA), is the tire industry’s largest event for dealers, retreaders, manufacturers and suppliers dedicated to the construction and earthmoving markets. For the 58th conference, representatives from 33 states and 18 countries came together at the Gran Melia Golf Resort and Spa in Puerto Rico to share ideas and learn more about the OTR tire industry.

The general sessions started on Thursday morning and they really represented the “meat” of the OTR Conference. One highlight was the presentation on production numbers by Amit Agarwal, manager, business analysis and forecasting for Bridgestone Commercial Solutions, a subsidiary of Bridgestone Americas Tire Operations LLC.

Agarwal started with a discussion on the OTR tire production over the last six years. According to his presentation, the industry is still a long way from returning to the production levels of 2007, but it has steadily rebounded from the low point of 2009. And while the increase between 2011 and 2012 was minimal, it was still an increase and therefore a positive sign that recovery is taking place.

On the subject of OTR tire distribution, Agarwal compared the original equipment and replacement markets over the same time frame. From 2011 to 2012, there was a 30,000 unit jump in the OE channel, while the replacement segment experienced a slight drop of about 20,000 units. This net gain of 10,000 units accounted for the overall increase in production indicated by Chart 1. It was also interesting to see that bias tires made a slight comeback in 2012 when compared to 2011, but radials still dominate the market at 70% of all production.

Agarwal then broke down production into the different OTR tire market segments so attendees could see where the production was going. Not surprisingly, the construction market comprised the majority of both OE and replacement production, followed by aggregate and then mining.

He defined the construction segment as tires with rim diameters of 25 inches or less. Over the last five years, the growth pattern in construction tire production followed the overall industry’s pattern. With housing starts and construction orders up, the upward trend is expected to continue.

In the aggregate segment, which he classified as tires with rim diameters of 29 to 49 inches, the news was even better. The market has fully recovered from 2009, and actually experienced a slight increase in 2012 compared to 2007. Since most of this is tied directly to construction, the industry can expect the same or a slightly increased level of demand for next year.

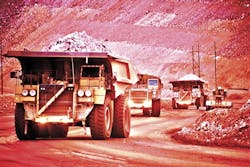

Finally, Agarwal addressed the mining segment (rim diameters of 51 inches or greater), in which the global demand for commodities has remained steady over the last few years (see Chart 3). The industry can expect similar results moving forward, he added.

In a departure from the last few years, TIA scheduled the motivational speaker for the Thursday session. Juan Antonio “Chi Chi” Rodriguez gave a moving speech on how hard work and dedication helped him rise from the sugar cane fields of Puerto Rico to become a professional golfer who was inducted into the Hall of Fame. For the golfers in the audience, it was a real treat to hear his stories about the game’s greatest players, like Palmer, Nicklaus and Hogan. But his incredible sense of humor and storytelling skills made it entertaining for everyone.

[PAGEBREAK]

Where is the OTR tire industry headed? Friday’s session featured two presentations that attempted to answer that.

The first speaker was Trevor Potter, vice president of sales and marketing at Schrader International Inc. As an international leader in consumer tire pressure monitoring system (TPMS) technology, Schrader has expanded into the earthmover market. According to Potter, if a fleet of 20 trucks runs 5,000 hours in a year and the tires are properly inflated, the tires will have an average service life of 4,000 hours, so 150 tires would be needed for the year. If the same fleet is just 10% underinflated, the tires will only average about 3,600 hours, so an additional 17 tires — costing $850,000 — would be needed.

Schrader also released the results of field testing at the Poltova Mine in the Ukraine. This mine uses the Caterpillar 785 rigid dump truck equipped with 33R51 nitrogen-filled tires on a 2.4-mile track that has 8% inclines. In a side-by-side test of trucks with and without tire pressure monitoring systems, the truck with TPMS had an estimated additional 8,537 miles in overall tire life. With an average savings of 13% to 15% and an average tire life of eight months, Poltova saves at least $25,000 per year.

In another test on a Hyster 46-36CH equipped with 18.00-33 tires, Schrader was able to use TPMS technology to collect temperature data that showed how the tread pattern and composition of the existing tire was incorrect for the application. The resulting change in tires doubled the average tire life from 600 to 1,200 hours. The addition of TPMS ended up saving the customer 50% in tire expenses and downtime.

The final speaker on Friday was Bruce Besancon, director of earthmover tire marketing for Michelin North America Inc. In his keynote speech, Besancon presented some key trends for 2013 that he felt would impact everyone in the OTR tire industry.

His first point was that continued change should be expected for the next year. The “wait and see” mood from consumers following the election is compounded by original equipment manufacturers adjusting their production schedules downward. And while residential construction is a bright spot, the downturn in coal mining is not expected to improve. He also forecasted growth for the Southeast Asian market; a decline in the European market; and the need to be cautious about the North American market.

Despite the current uncertainty, Michelin still sees long-term growth for the OTR industry and has doubled earthmover tire manufacturing capacity in the last seven years.

Besancon then identified what he called the “Final Four” for OTR tire customers when it comes to the manufacturers: reliability, availability, value and performance. He hammered home the point that brand awareness and original equipment are not nearly as important as the Final Four. Over the life of a large haul truck, the operator ends up spending more on tires than he or she would on the initial purchase price of the truck.

The keynote address ended with reminders for the audience that today’s earthmover customer wants more than just tires. Besancon said they are looking for information and support, so the tire industry must utilize all forms of technology to create value for the end users.

With so many factors having an impact on the life of the tire, everything from the condition of the site to maintenance and performance of the operators must be tracked, measured and reported in order to maximize performance. And while price is always a factor, the most important thing is to compute the total cost of ownership and show end users how they can operate more efficiently.

[PAGEBREAK]

On Saturday morning, Roy Littlefield, TIA’s executive vice president, offered his thoughts on how the 2012 elections would impact the tire industry. A 30-year veteran inside the beltway, Littlefield cautioned attendees that they should expect more of the same stalemate with the Senate in Democratic control and the House majority in the hands of the Republicans.

He also relayed his thoughts on how the nation’s governors are concerned about not only Obamacare but also the current administration’s insistence on raising taxes to fund entitlement programs — and how this puts the tire industry in a difficult position. Littlefield summarized his presentation with a plea for the industry to work together or suffer the consequences of being on the defensive for years to come.

The next speaker on Saturday was Brett Eckstein, executive director of Tire Stewardship Manitoba (TSM). The stewardship is a partnership between the industry and the government to create a not-for-profit organization to manage scrap tires in the province of Manitoba, Canada.

Tire dealers add an Eco-Fee to every tire purchase that ranges from $4 for passenger and light truck tires, $9 for medium truck and small farm tires, and $60 to $135 for OTR tires (depending on the size).

Since the money is collected and spent only by TSM, the tire fees that retailers are forced to collect in the states do not go the state treasury, where it easily can be allocated to other areas. As a result of the transparency, every dollar that goes into TSM is accountable to the stakeholders who collect it (retailers) and the public that ultimately pays.

Eckstein also showed an excellent public service video that TSM is using to spread awareness of how the fees are solving the environmental problems of scrap tires and actually creating jobs. The video outlines how Manitoba has more than 1,400 collection points where the citizens of the province can drop off a scrap tire at no additional charge, so there is no reason for people to dispose of them in ditches, waterways, and illegal dumps.

Virtually every tire collected in Manitoba is recycled and re-used in Manitoba, and the video shows the viewer the many different ways that scrap tires are being reused in the province.

The last two presentations on Saturday morning were given by Jeff Faubion, technical compliance trainer for Bridgestone Commercial Solutions, and Kevin Rohlwing, TIA’s senior vice president of training. Faubion provided the audience with valuable tips on how to perform a pre-trip inspection that will help comply with Mine Safety and Health Administration (MSHA) regulations.

One particular regulation that seemed to get everyone’s attention was 30 CFR 56.14205, which says “Machinery, equipment and tools shall not be used beyond the design capacity intended by the manufacturer where such use may create a hazard to persons.” This basically means that every tool on the service truck must be in good working condition because a broken tool on the truck could be used and result in an accident.

He also reminded attendees that all chains must have hooks and include a tag that shows the maximum load.

[PAGEBREAK]

Rohlwing shared some disturbing data regarding accidents in the tire industry.

He said 19 workers were killed in the United States from 2011-2012 as the result of a falling vehicle; this represents the number one hazard to all types of tire service technicians. Since only one of the accidents appeared to involve a jack stand, it is reasonable that most of them could and should have been prevented.

Rohlwing also discussed the importance of deflating both tires in a dual assembly before attempting to remove them from a vehicle, and used a video from Ken-Tool Corp. to demonstrate the explosive force created by an inflated OTR tire on a multi-piece rim when a separation occurs inside a restraining device.

The 59th TIA OTR Conference will be held at the Marco Island Marriott Resort & Golf Club in Marco Island, Fla., Feb. 19-22, 2014. For more information, visit the TIA website at www.tireindustry.org. ■

Growth opportunities: Panel discusses retreading in 2013

Seven members of the Tire Retread and Repair Information Bureau (TRIB) discussed opportunities for 2013 at the recent Tire Industry Association Off-the-Road Conference.

The panelists were: Mike Berra Jr., Community Tire Co., St. Louis, Mo.; Dennis Bull, B.R. Retreading, Glasgow, Ky.; Brian Hayes, Purcell Tire & Rubber Co., Potosi, Mo.; Noah Hickman, H&H Industries Inc., Oak Hill, Ohio; James John, Shrader Retreading, a division of Craft Tire Inc., Greenville, Ohio; Ed Petros, RDH Tire & Retread Co., Cleveland, N.C.; and Frank Schmidt of McCarthy OTR Retreading Inc., Somerset, Pa.

They said growth opportunities for 2013 include:

• the 51-inch and above segment;

• potential opportunities to invest in equipment, with continued low interest rates;

• international customers.

A number of panelists also mentioned the importance of improving the end-user perception of retreaded tires by ensuring the finished product looks as close to a new tire as possible.