Private 'ayes': Dealers influence the private brand tire-buying decision with finesse and good, old-fashioned salesmanship

Why do tire dealers buy a line of private brand tires, and why do their customers buy private brands from tire dealers? Answers to these questions hold the key to the success of the private brand tire market.

And we have the answers! Modern Tire Dealer conducted a survey of 1,000 of our readers. Their operations break down as follows: 58% retail, 25% wholesale and 17% commercial.

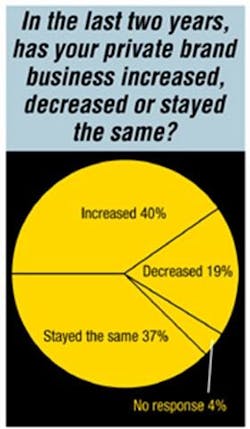

For 77% of the responding dealers, private brand tire sales have increased or held steady.

And for a majority of those dealers who experienced a decrease in private brand sales, the decreases were minor.

Sixteen percent of the responding dealers are planning to add a private brand tire line in the next 12 months, while 13% said they are planning to drop a private brand tire line.

Perhaps most importantly, 38% of the dealers say private brands are easier to sell than major brands.

Price is right

Price barely won out as the top reason dealers choose one private brand tire line over another. It was followed closely by product quality, fill rate, line coverage, market exclusivity and territory protection.

(Price also was the top reason for a dealer to choose a private brand line in MTD's 1996 Private Brand Tire Survey -- but by a much wider margin.)

Phil Berra, president of Community Wholesale Tire Distributing Inc. in St. Louis, Mo., says he sees a shift in major brands vs. private brands.

"As the market has shifted, there also has been a shift toward major brands in our overall sales," he admits. "It used to be 70/30 for private brands. Now it's closer to 50/50.

"But the number-one reason people buy tires is because of the tire dealer. So if dealers push private brands, customers will buy them."

Berra sells Hercules, Merit, Remington, MAST (Michelin Americas Small Tires) products, Bridgestone, Firestone, Toyo, Dunlop and other tires. Some 85% of Community Tire's business is wholesale, but the company also operates seven retail stores.

Perceived value

Forty-nine percent of the surveyed dealers said their customers rate major brand quality as somewhat better than private brands. Twenty-six percent of the dealers think their customers perceive no difference between major and private brand quality, while 4% think their customers judge private brand quality as being "somewhat better" than major brand quality.

Jim Looney, president of Looney's Tire Service in Little Rock, Ark. has been selling tires for 30 years, and a lot of his business comes from loyal, repeat customers. "A very small percentage of our customers come in and request a certain brand tire," he says. "We sell our customers the tires we think they need. And 80% to 90% of our customers go with our recommendations."

Looney's $15 million business is split into 20% retail, 40% wholesale and 40% commercial sales. He sells Delta, Toyo and Bridgestone tires.

Ken Harris, co-owner of Harris Tire Co. in Troy, Ala., says private brand tires are comparable to flag brand products in terms of quality. The challenge is getting retail customers to think in those terms -- though events like the Firestone recall have helped.

"Customers are more receptive to private brands, especially in small-town America," he says. "In smaller towns, if people find a good dealer who sells them a good tire, they'll go back. It boils down to service."

Harris Tire distributes Summit and Remington brand passenger, light truck, rear farm and medium truck tires to several hundred customers throughout the southeastern United States via five warehouses. The company also wholesales Del-Nat Tire Corp.'s National brand.

Some customers hold private and associate brands in higher esteem than flag labels, says Bob Potter, president of Area Wholesale, a Baton Rouge, La.-based operation that distributes Remington brand tires to some 3,000 customers in Louisiana, Texas, Arkansas and parts of Alabama and Mississippi.

"Look at the Firestone problem," he says. "We don't have that with private brands. Our merchandise goes on the automobile after it's been used," unlike major brand original equipment tires. As a result, according to Harris, drivers subject private brand tires to less scrutiny.

Chuck Kaiser, president of Eldorado Tire of Kentucky in Louisville, Ky., often works the floor of his retail store, which does business as Kaiser Tire. That gives him a first-hand perspective on customers' private label expectations, and he's learned that most customers buy what he recommends.

"All you have to do is tell (them) that the private brand is manufactured by a major brand," he says. "A little salesmanship convinces customers. The retail customer is not knowledgeable about what he's putting on his vehicle."

Kaiser started selling the Eldorado brand when his dealership opened in 1970. He also sells Jetzon brand passenger and light truck products.

Kaiser wholesales tires under the Eldorado Tire of Kentucky banner.

Kaiser says his company achieves a 14% mark-up at the wholesale level with his private brand tires. His 32-year-old company's private brand margins are up from last year, which reflects the segment in general, he says.

"Too many private brand dealers try to give their products away," he says. "Customers aren't looking for you to give away something for nothing. Some of them may only be able to afford an entry-level tire, but nobody (wants) a handout. We put a nice mark-up on our tires that we think is fair, and very seldom do we get any complaints."

About the Author

Bob Ulrich

Bob Ulrich was named Modern Tire Dealer editor in August 2000 and retired in January 2020. He joined the magazine in 1985 as assistant editor, and had been responsible for gathering statistical information for MTD's "Facts Issue" since 1993. He won numerous awards for editorial and feature writing, including five gold medals from the International Automotive Media Association. Bob earned a B.A. in English literature from Ohio Northern University and has a law degree from the University of Akron.