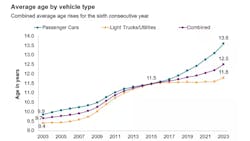

Average Vehicle Age Tops 12 Years

The average age of cars and light trucks in the U.S. has reached a new record of 12.5 years, according to a report from S&P Global Mobility.

"This is the sixth straight year of increase in the average vehicle age of the U.S. fleet," say S&P Global Mobility officials.

"It also reflects the highest yearly increase since the 2008-2009 recession, which caused acceleration in average age beyond its traditional rate due to the sharp decline in new-vehicle sales demand."

There are more than 284 million light duty vehicles in operation in the U.S.

The number of passenger cars on U.S. roads is at its lowest point since 1978, says S&P Global Mobility.

A deeper look

"In 2022, the average (vehicle) age experienced upward pressure initially due to supply constraints that caused low levels of new vehicle inventory and then by slowing demand as interest rates and inflation reduced consumer demand in the second half of the year.

"The combined effect caused retail and fleet sales of new light vehicles in the U.s. to drop 8% from 2021's 14.6 million units to 13.9 million units in 2022, the lowest level recorded in over a decade."

"We expected the confluence of factors impacting the fleet coming out of 2021 would provide further upward pressure on average vehicle age, but the pressure was amplified in the back half of 2022 as interest rates and inflation began to take their toll," notesTodd Campau, associate director of aftermarket solutions for S&P Global Mobility.

Good for tire dealers

The increased pace of growth of the average light vehicle age benefits the vehicle service industry, according to S&P Global Mobility. "An older fleet means vehicles will continue to need repair work and service to perform correctly.

"The aftermarket sector trajectory typically follows growth in average vehicle age, as consumers invest more to keep their aging vehicles running, barring some exceptions. As a result, the most recent S&P Global Channel Forecast conducted jointly with Auto Care Association and MEMA Aftermarket Suppliers, estimates revenues of the U.S. light duty aftermarket in 2022 have grown to $356.5 billion, up more than 8.5% over 2021.

"For this year, early indications from the same forecast estimate a potential revenue increase in 2023 of 5% or more, prior to adjustments for inflation and other factors."

According to S&P Global Mobility, the volumes of vehicles ages 6 to 14 years old will grow by another 10 million units by 2028, adding to an already favorable volume of vehicles in the aftermarket target range.

"Traditionally, the 'sweet spot' for aftermarket repair was considered 6 to 11 years of age, but with average age at 12.5 years, the sweet spot for aftermarket repair is growing," says Campau. "There are almost 122 million vehicles in operation over 12 years old."

In total, vehicles older than six years will account for more than 74% of the vehicle fleet in 2028, according to S&P Global Mobility estimates.

"These vehicles drive the most repair opportunities and should serve as a positive trend for the independent aftermarket.

"Despite economic headwinds, new vehicle sales are projected to surpass 14.5 million units in 2023, according to S&P Global Mobility forecasts, which is expected to curb the rate of average age growth in the coming year."

"While pressure will remain on average age in 2023, we expect the curve to begin to flatten this year as we look toward returning to historical norms for new vehicle sales in 2024," notes Campau.

Focus on LT/CUV

"Light truck/utility growth has trended upward for several years, and in 2022, 78% of all new vehicles registered in the US last year were in this category," add S&P Global Mobility officials. "Given the exponential growth of the sport utility segment, VIO has shifted as well - with light trucks/utilities representing nearly 63% of the population.

"Strong consumer preference for light trucks over cars points to a growing business potential for the vehicle service industry, as light trucks/utilities generally cost more to maintain than cars, and people also tend to keep them longer.

"Our analysis shows that within the next 18 to 24 months, the total volume of passenger cars - sedans, coupes, wagons, hatchbacks - on the road in the U.S. could drop below 100 million for the first time since 1978. By 2028, we expect at least 70% of VIO in the US to be light trucks/utilities."