An unexpected surge in domestic truck tire demand in the second half led to a record number of replacement truck tire shipments in 2017. Unable to produce enough tires to meet the demand, Tier 1 and Tier 2 manufacturers lost market share versus 2016.

The U.S. Tire Manufacturers Association (USTMA) estimates domestic replacement and original equipment truck tire shipments totaled a record 25.1 million units, broken down as follows:

Replacement: 19.7 million.

OE: 5.4 million.

USTMA members produced 14 million units in the U.S. last year, more than 11 million units less than total U.S. shipments. In addition, USTMA members exported 2.5 million truck tires.

The 12 companies that make up USTMA’s membership are Bridgestone Americas Inc., Continental Tire the Americas LLC, Cooper Tire & Rubber Co., Giti Tire (USA) Ltd., Goodyear Tire & Rubber Co., Hankook Tire America Corp., Kumho Tire U.S.A. Inc., Michelin North America Inc., Pirelli Tire North America Inc., Sumitomo Rubber Industries Ltd., Toyo Tire Holdings of Americas Inc. and Yokohama Tire Corp.

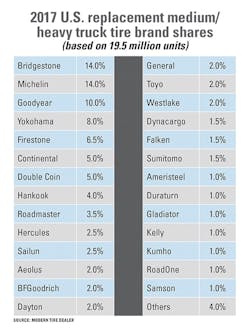

Modern Tire Dealer estimates a record 19.5 million radial and bias medium and heavy truck tires were shipped in the U.S. last year.

Truck tire imports

China was the largest exporter of truck tires to the U.S. last year, accounting for 6.2 million units. And that number will reach at least 10 million tires this year, based on available government import numbers to date.

Through the first three months, Chinese truck tire imports, predominantly radial, are up close to 60%. Imports from Vietnam (more than 1,800%!), France (close to 100%) and Italy (90%) also are up dramatically.

Truck tire imports from Thailand, where a number of Chinese tire manufacturers have built plants the last few years to avoid heavy tariffs, are up 5.6%, while Japanese imports are up 3.5%.

What to expect

At least through the first quarter of 2018, USTMA member truck tire shipments are down, while non-USTMA member shipments are up significantly. That is despite Cooper Tire & Rubber Co.’s 1Q performance; the company says its truck tire sales are up 25%.

On April 6, 2018, USTMA’s forecast for this year was positive: U.S. replacement shipments will increase 1.7%, to 20 million units, while OE shipments will increase 3.7%, to 5.6 million units. Already through April, overall shipments are up, with OE shipments leading the way.

Cooper introduced its namesake TBR tire brand in March. The brand will target fleets and original equipment manufacturers, while Roadmaster will primarily target owner-operators and trailer manufacturers. Cooper is relying on its “commercial servicing dealerships” for distribution in the U.S.

The average price of a medium/heavy truck tire in 2017 was $348.71. Because raw material prices are expected to rise steadily throughout the rest of this year, price increases from the manufacturer to the dealer are possible.

Competition from low-cost radials produced in China is expected to remain a thorn in the side of both new tire manufacturers and retreaders in the U.S. One Chinese company in Qingdao recently offered 295/75R22.5 16-ply Aeneas HS205 steer tires to U.S. dealers for $123 apiece. Even with FOB costs, that’s pretty low. ■

About the Author

Bob Ulrich

Bob Ulrich was named Modern Tire Dealer editor in August 2000 and retired in January 2020. He joined the magazine in 1985 as assistant editor, and had been responsible for gathering statistical information for MTD's "Facts Issue" since 1993. He won numerous awards for editorial and feature writing, including five gold medals from the International Automotive Media Association. Bob earned a B.A. in English literature from Ohio Northern University and has a law degree from the University of Akron.