In 2Q12, Cooper Tire saw its North American volume increase by 15% while Goodyear’s replacement volume in N.A. fell by 10%. The overall market was relatively flat with 2Q11. Yet, Cooper’s operating margin in N.A. that quarter was 8.4% while Goodyear’s was not too different at 7.7%. Why the sharp difference in volume? Goodyear’s strategy is highly focused, emphasizing premium and high performance tires while eschewing value tires while Cooper offers a wide range of products at varying price points. Yet despite the sharp difference in volume patterns, both companies had record earnings for a second quarter! The point is that different approaches can work and no one strategy works for every participant. Both companies delivered results that pleased their shareholders and both stocks moved higher post reporting 2Q12 earnings. This is not meant to be a forecast of future performance, but both companies can win despite having sharply different product strategies.

Monthly survey

A number of independent tire dealers were surveyed concerning current business trends. Except for tire prices and costs, the results of the July 2012 survey are compared with those of July 2011.

Optimism continues to fade

According to our dealer survey, roughly 25% of passenger tire dealers believe business will improve over the next six months while 63% believe it will stay about the same. Some 12% believe it will worsen. As for truck tire dealers surveyed, 25% see business improving while another 63% see business staying about the same. Twelve percent say it will worsen. Dealers are citing low consumer confidence as a key concern and are beginning to believe that there is no pent-up demand coming to the rescue. These outlook comments tend to be seasonally directed rather than year-to-year comparisons.

Volumes down 3% in July vs. last year

According to dealer reports, on average, retail sales of new replacement passenger tires were down 3% when compared with July 2011. Consumers continue to be conservative with spending given the uneasiness in the economy and with the election on the horizon. On the plus side, miles driven continue to increase but gas prices have begun to creep up again which could slow down these increasing driving patterns. Truck tire sales were up 2% in July reversing the negative growth seen last month while retreaded tire sales were up 8%.

Tire prices continue to trend downward

In comparing July 2012 with June 2012, the average cost for a size 215/60R16 major brand tire was flat while the average price was down 1%. The average cost and price for a 215/60R16 private brand tire were down 1%.

Pricing gets aggressive on passenger tire side

In July 2012, 75% of passenger tire dealers saw pricing as aggressive while the remaining 13% saw it as normal. Twelve percent of the passenger tire dealers saw it as firm. However, 63% of truck tire dealers saw pricing as normal while the remaining 37% seeing it as aggressive. Tire prices are falling and dealers expect them to continue to fall in the face of much loser raw material costs. Raw materials, such as natural and synthetic rubber, have fallen drastically from highs seen earlier in the year, but have stabilized in recent weeks.

Inventories increase in the face of weak demand and increased shipment

The survey indicated that 75% of passenger tire dealers believed inventories were too high, with the other 25% believing inventories were in line with current business levels. Roughly 63% of truck tire dealers we surveyed indicated inventories were in line with current business levels, while 37% felt inventories were too high. Inventories increased sharply during the month as manufacturer shipments increased 4% while dealer sales volumes were down 3%.

Service business continues to show strength

Dealers who provide automotive service reported that 26% of revenues, on average, were generated by service during July. Dealers indicated that service business grew by 6% in July 2012 vs. July 2011. Service business continues to be a great growth driver for dealers.

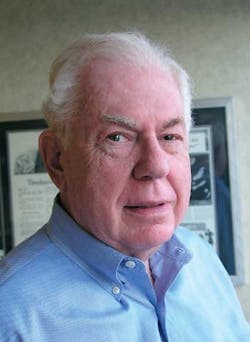

Analyst Saul Ludwig is a managing director with Northcoast Research Holdings LLC based in Cleveland, Ohio. He concentrates on the tire and chemical industries. He has been writing for Modern Tire Dealer since April 1975. Ludwig is retiring this month, and this is his last column for MTD. Please see his comment below.

A personal comment:

“Having covered the tire industry as an analyst for 45 years, the time has come to move to the next chapter in my life. That means having time for taking college courses, exercising more regularly, spending more time with my wife (of 51 years) and my six grandchildren and travelling to new places. I am excited that two of my fellow analysts, John Healy and Nick Mitchell will now handle the tire industry for Northcoast Research. Both are outstanding analysts and I am confident they will do well. From a personal standpoint, I sincerely thank all those dealers who have been especially helpful to me for so many years. It has been both fun and challenging to cover this industry and it has made me so appreciative of the challenges a tire dealer faces day in and day out. Best personal wishes for ongoing success.”