During my career, I’ve spent a considerable amount of time talking, laughing and getting emotional about the stories I hear from tire dealers.

This includes the excitement of starting a new venture and the long hours of establishing a new business as a destination for people’s second largest investment, as well as the heartache of disappointing a valued customer and the frustration of even being accused of doing something you didn’t do — not to mention the overall stress of running a small business.

Much of the pressure, strain and tension from running a small business has to do with keeping the doors open and ensuring there’s enough cash flow to make payroll. In the beginning, you can forget about net profit. Just please let there be enough cash in the account to cover payroll! That’s something an employee never has to worry about. But even after hits, misses, swings, strikeouts and home runs, payroll is just the first expense on the profit and loss statement. There’s a cavalry of fixed and variable expenses that also must be paid.

In the automotive and tire aftermarket, the standard bearer of success has been 10 cents on the sales dollar. If 10 cents makes it from top line to bottom line, you have good business. With 10 cents, you can make all your expenses, pay yourself — finally — and move the little bit left over to a balance sheet, where taxes, accounts payable and other items take another bite — and you start growing your cash reserves and even (time for a hushed whisper) any retained earnings.

I say all of this because ultimately conversations with owners almost always come down to how to make more money, either in sales, gross profit or net profit.

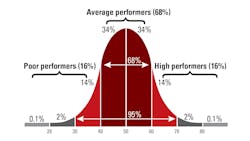

Most stores operate within a bell curve of profitability, as depicted in the image above.

The large middle section is almost 70% of stores, representing operations that are staffed accordingly — to financial, but not always to the store manager’s contentment — have adequate vehicle count and an average repair order of a couple hundred dollars, roughly a third of which is tires, a third parts and a third labor.

This is what generates the 10-cent profit on a dollar sale. More labor? More profit. More tires? Lower margins of gross profit and higher sales dollars. Lower car count or lower repair orders? Not going to get 10 cents. It disappears in expenses.

If your business falls into the 70% — with a couple of service advisors, a few more techs than advisors, a double-digit daily car count and at least a basic vehicle inspection process — you should be treading water financially. So stop focusing on profit.

What I mean to say is, by focusing too much on profit, you’re infecting the process. You’re poisoning the well. By over-focusing on results instead of process, you’re getting the attention of the doers, the individual contributors of the business, but are forcing them to focus on the outcome: how much money they make off a sale.

This will very quickly and easily translate into the communication style in your dealership and with your customer. It won’t be blatant, of course. But customers will sense it. And they won’t be back. This means you’ll have to increase expenses to reach more customers — only to risk turning them off on a first visit.

Establishing a level of trust that adequate car count and an attentive advisor who asks pertinent questions before the process begins will give valuable information to the crew working on the cars and trucks. Be wildly passionate about discovering what’s important to the customer before the work starts. That’s where the profit is. It’s locked up with the customer. They pay the bills. They cover your dealership’s payroll.

As an owner, you should be 100% focused on the process, experience and steps — whatever you want to call it. That’s how it happens. The result has been cast in stone for 100 years. Friendly, engaged employees reduce customer stress. Less-stressed customers spend more money than stressed ones. Profits are then reinvested in the business to accommodate more customers.

If you get to — or have ever been a part of — a store that figures this out, you’ll never forget it. Imagine 30 cars a day out of six bays with an ARO of $400. You’re now living on the right side of the bell curve, where you’ve outpaced fixed expenses. The only stress you’ll experience is how the heck you’re going to get it all done today.

Dealers who find themselves on the left side of the bell curve need to focus on volume, so customers can become loyal to the process. Stores in the curve refine their process to get from 10 cents to 12 cents. Stores on the right-hand side? Have fun operating in controlled chaos. Profit happens because of the right process with the right people. You can’t force it.

About the Author

Dennis McCarron

Dennis McCarron is a partner at Cardinal Brokers Inc., one of the leading brokers in the tire and automotive industry (www.cardinalbrokers.com.) To contact McCarron, email him at [email protected].